georgia estate tax calculator

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Wealth is determined by the property a person owns.

An estate tax is a tax imposed on the total value of a persons estate at the time of their death.

. 1110 of Assessed Home Value. Atlanta Title Company LLC 1 404 445-5529 Residential and Commercial Real Estate Lawyers 945 East Paces Ferry Rd Resurgens Plaza. Property Taxes in Georgia.

0910 of Assessed Home Value. However because Georgias highest income bracket tops out at 7000 10000 if married filing jointly per year the vast majority. Georgia Estate Tax Calculator.

Some areas do not have a county or local transfer tax rate. For comparison the median home value in Georgia is 16280000. For comparison the median home value in Habersham County is.

Seller Transfer Tax Calculator for State of Georgia. Garden City GA 100 Central. Property Tax Homestead Exemptions.

You are able to use our Georgia State Tax Calculator to calculate your total tax costs in the tax year 202223. The median real estate tax payment in Georgia is 1771 per year which is around 800 less than the 2578 national mark. The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state.

1030 of Assessed Home Value. All real property and all personal. This calculator can estimate the tax due when you buy a vehicle.

Our calculator has recently been updated to include both the latest Federal Tax. Property Tax Returns and Payment. See How Much You Can.

Property tax is an ad valorem tax--which means according to value--based upon a persons wealth. This means the higher your income the higher your tax rate. Tax June 21 2022 arnold.

To calculate the exact property tax saving a Southbridge property owner would realize if annexed into Garden City enter your property value into the box below. The real estate transfer tax is based upon the propertys sale price at the rate of 1 for the first 1000 or fractional part of 1000 and at the rate of 10 cents for each additional 100 or. One of the biggest.

Georgia Estate Tax Calculator. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. The average effective property tax rate is 087.

For comparison the median home value in Fulton County is. County Property Tax Facts. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

It is sometimes referred to as a death tax Although states may impose their own.

The Tax Rate On A 2 Million Home In Each U S State Mansion Global

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj

Georgia Property Tax Calculator Smartasset

Property State And Local Taxes Are Still Deductible Up To A Point Tysllp

Georgia Estate Law Faulkner Law

Estate Planning 101 Your Guide To Estate Tax In Georgia

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Step Up In Basis Archives Policy And Taxation Group

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

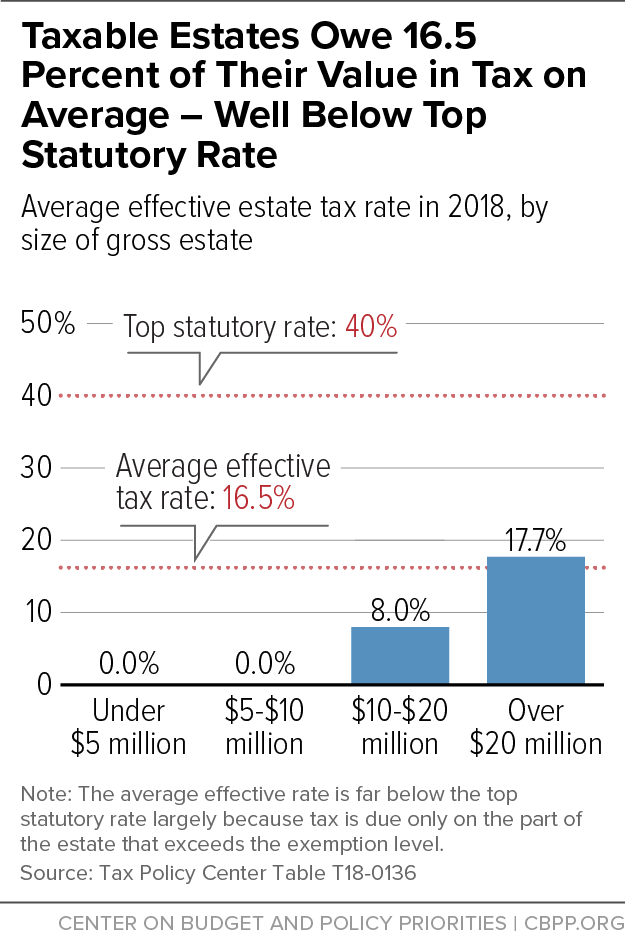

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Irrevocable Trusts What Beneficiaries Need To Know To Optimize Their Resources J P Morgan Private Bank

States With No Estate Tax Or Inheritance Tax Plan Where You Die

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning

State Individual Income Tax Rates And Brackets Tax Foundation

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Estate Inheritance And Gift Taxes In Connecticut And Other States

Policy Basics The Federal Estate Tax Center On Budget And Policy Priorities